Please be affected person. It often takes 30 days for people to contest a chargeback, and it could take your purchaser’s credit card firm how to avoid paypal chargeback approximately 75 days to come back into a final determination and answer a charge-back.

This preserve will stay set up while you assist the buyer to solve the claim and may be released again to you personally if the state is settled in your favor. To get Item Not really Received (INR) claims, as you present the relevant info because outlined within the Seller Proper protection Policy, and the claim is decided in your favor, the amount of money may be released for you. Once a declare has been registered, the best thing to perform is promptly present any requested info.

Proving the cardholder was aware of and approved the transaction becoming disputed is crucial. Any data that discloses proof of this, including AVS (handle verification system) matches, CVV confirmations, agreed upon receipts or contracts, or perhaps an originating IP matching the customer’s location are a must. The majority of banks gained’t even contemplate the rest of the response while not this information. It’s obvious that in the world of chargebacks, card systems nearly all enough time aspect with cardholders.

How exactly does PayPal handle chargebacks?

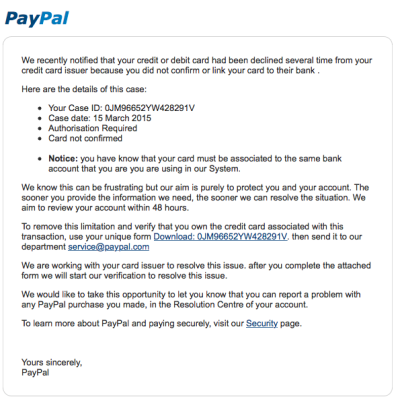

DEAL WITH DUBIOUS ACTIVITY By PayPal we understand you, consequently any email from us will treat you by your first and last name or perhaps your business identity in the body with the email. A message from PayPal do not ever ask you to give sensitive facts like your security password, bank account, or card details.

Con artists Be Scamming – My personal Experience With A PayPal Charge-back

It’s in a vendor’s finest curiosity to work with the customer to solve the argument. This is a seller’s likelihood to make use of great customer support to resolve a problem that help forestall this from developing into one element larger. Definitely, not obtaining chargebacks by any means is the ideal … on the other hand so long as the machine exists, it is possible that cardholders will contest transactions, particularly in response to lawbreaker fraud. When that happens, the best a merchant can hope for is usually to study with regard to the chargeback ahead of it’s truly filed.

The mover probably would not accept funds and if I actually write a verify or spend by CC, so could too, the consumer! The item weighs less than twenty lbs.

We have a studio company. We had a buyer document a claim in opposition to all of us via his CC provider then they notified pay mate which pay pal notified us of a claim. Psy pal hasnt charged us again, they’re investigating the declare and now have given our resistant. He had granted all of us a 50%deposit which is forced to start out the roles and get the procedure began.

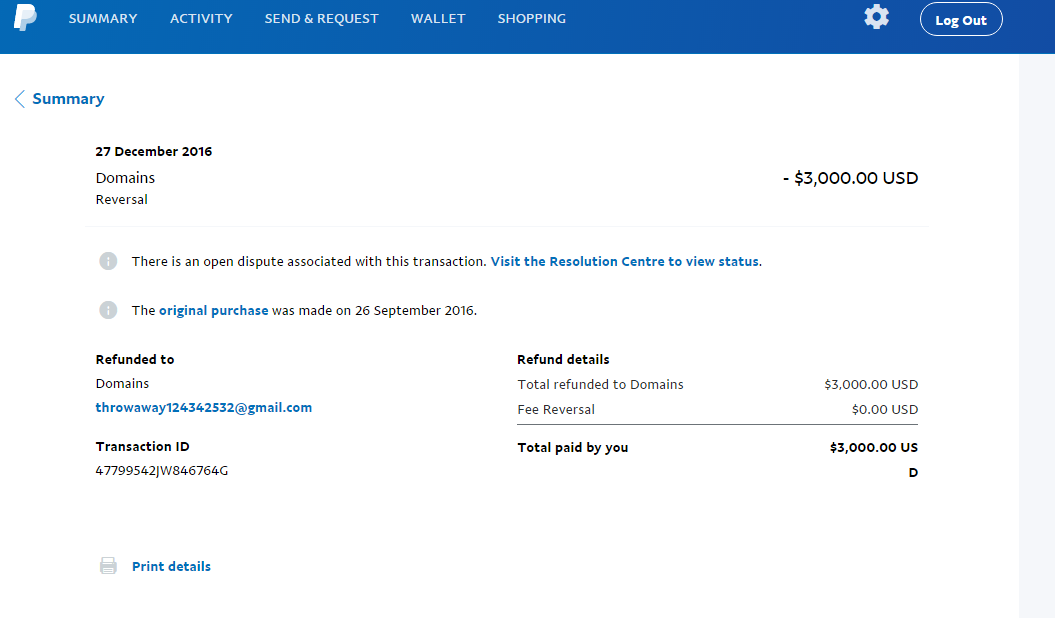

- Then we’ll place a brief maintain about all funds in the deal.

- In some cases, the service provider might even be included to the Terminated Merchant Document, leading to a blacklisting by simply acquirers, possibly destroying the full enterprise.

- Nevertheless , if a supplier goes out of business or perhaps stops producing funds through PayPal, we will use any reserve to satisfy future payment reversals.

- This wiped out the adverse stability instantly.

- Several payment cpus will cost a merchant with respect to chargebacks to cowl administrative costs.

- Lynch says the new good recommendation to benefit from these notices so you can address chargebacks promptly.

What is a charge-back in accounts receivable?

PayPal Seller Safeguard covers you in the event of claims, charge-backs, or reversals that are the result of unauthorized purchases or products your consumer didn’t receive. With PayPal Seller Safety, you happen to be covered designed for the full amount of all entitled transactions.

Our product owner commercial lender informs us of the charge-back, and we immediately e mail the seller. The seller are able to log in with their PayPal profile and proceed to the Resolution Centre to observe the standing up of the case and provides information to help eliminate the matter.

The chargeback mechanism exists largely for client security. Holders of bank cards issued in the us are afforded reversal privileges by Regulation Z on the Truth in Lending Function. United States debit card cases are confident reversal rights by Regulation E of this Electronic Fund Transfer React. Similar legal rights lengthen internationally, pursuant to the rules structured on the corresponding cards association or perhaps financial institution network. Chargebacks as well occur within the distribution investment.

What Happens When Chargebacks are Granted?

For event, PayPal can compile inner info and mix that with details you show dispute a chargeback, per credit/debit credit card guidelines. Basically having a chargeback filed against you’ll not mechanically have an effect on your vendor recommendations.

You can view the chargeback payment and process in ourUser Arrangement. Had PayPal’s service provider standard bank not taken the cash for that charge-back, PayPal didn’t currently have wanted to move the vendor’s funds. Be aware that if the argue is found in enjoy of the merchant, PayPal will credit score the Seller’s profile with the disputed funds. Other kinds of chargebacks happen to be associated to technical concerns between the provider and the providing financial institution, for example when a client was incurred twice to get a single transaction.

Paypal is truly the worst in terms of seller rights. If a client submits their ask for a return properly, My spouse and i don’t think about there is any kind of means for it to fail.

This course of generally takes about thirty days, however extra advanced instances may take longer than 30 days. Once a claim is opened, you might have 20 times to work with the consumer to resolve it. (PayPal gained’t be involved with this level. ) If neither of them you nor the customer escalates the contest in the course of the 20-day home window, it will be closed automatically.