Can forex trading be self taught or do you need to attend those expensive seminars as a beginner?

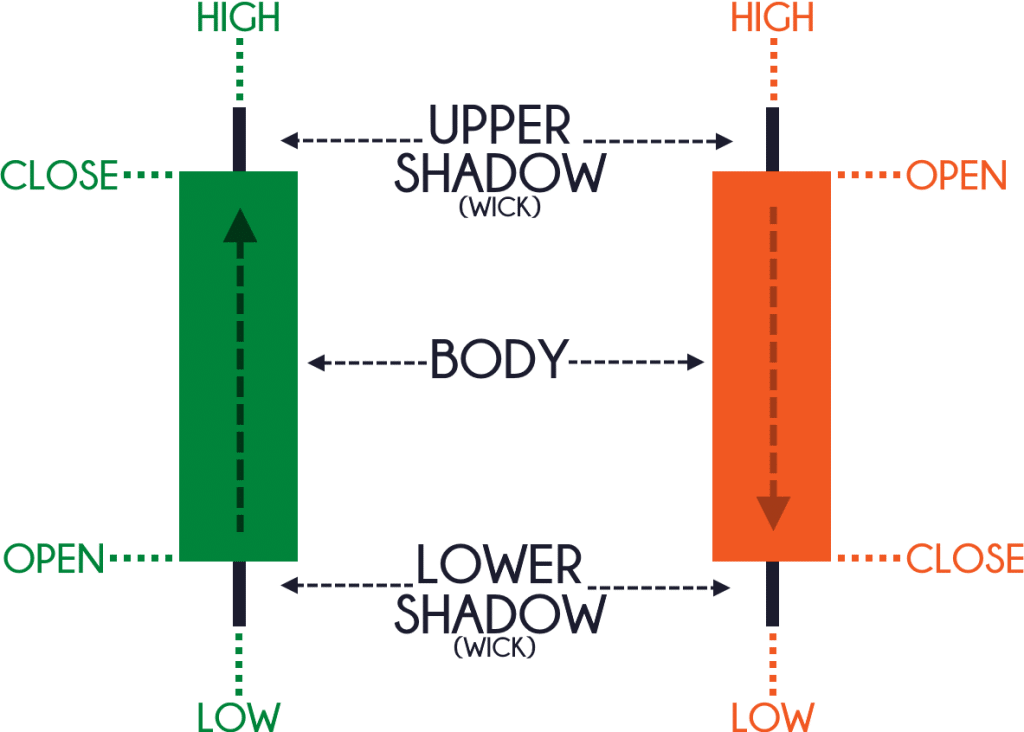

Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account. There are many types of forex software that can help you learn to trade the forex market.

How did Forex trading change your life?

Similarly, a serious trader needs to invest time and effort into developing a thorough trading strategy. As a bare minimum, atrading plan needs to consider optimum entry and exit points for trades, risk/reward ratios, along with money management rules. As a result, traders risk smaller portions of the total investment per trade, while still accumulating reasonable profits. Here it is important to learn how to stop losing money in Forex trading due to improper account management.

ECN brokers offer a very small spread, making it easier to trade profitably, but they typically charge about $2.50 for every $100,000 traded ($5 round turn). A higher win rate for trades means more flexibility with your risk/reward, and a high risk/reward means your win rate can be lower and you’d still be profitable. Choose from spread-only, fixed commissions plus ultra-low spread, or Direct Market Access (DMA) for high volume traders. Trade a wide range of forex markets plus spot metals with low pricing and excellent execution. I think it also depends on the country where the trader is located.

Instead, he stresses that you need to work out how to make money when being right only 20 to 30 percent of the time. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. https://forex-trend.net/ 76% of retail investor accounts lose money when trading CFDs with this provider.You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Let’s begin our review of some of the best Forex success stories by looking at one of the industry’s legendary beacons of good fortune, George Soros. If we were to ask, „Who is the greatest forex trader? “ Soros‘ name would certainly always Investment Banking figure high on any list. Mr Soros is known as one of the greatest investors in history. He sealed his reputation as a legendary money manager by reportedly profiting more than £1 billion from hisshort position in pound sterling.

This would reduce the net profit potential generated by your $5,000 trading capital to $1,485 per month. It results in a larger loss than expected, even when using a stop-loss order. It won’t always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods. Forex brokers often don’t charge a commission, but rather increase the spread between the bid and ask, thus making it more difficult to day trade profitably.

Why would someone expect to make lots of money from $100? If someone is trading with such low amounts, then they should expect low returns… It’s that simple. This split money management works well with risking dollar amount not the 2% that brokers are promoting. Both trades have same stop loss and opened same time, using price action signal.

- Now, in a perfect world you would relish the idea that you just pulled out a 4% profit in just four trading days.

- It results in a larger loss than expected, even when using a stop-loss order.

- The data that is available from Forex and CFD firms (albeit a very small slice of the vast global FX market) suggests that it’s rare for people to become hugely successful traders.

- The advantage for the beginning trader is that you can open an account and begin trading with $100 or less.

- Introductory books on strategies and theories will help you get acquainted with the playing field.

- That means you can afford to lose the entire amount without it affecting your day to day life.

What type of forex trader are you?

Traders should know that market volatility can spread across hours, days, months, and even years. Many trading strategies can be considered volatility dependent, with many producing less effective results in periods of unpredictability. So a trader must always make sure that the strategy they use is consistent with the volatility that exists in the present market conditions. Profitable traders prefer to report forex trading profits under section 1256 because it offers a greater tax break than section 988.

As the market reacts to these events, there’s an inevitable impact on supply and demand for respective currencies. Lastly, the inability to distinguish trending markets from ranging markets, often results in traders applying the wrong trading tools at the wrong time. The good news is that these market changes present not only new risks, but also new trading opportunities.

Currently, spread betting profits are not taxed in the U.K., and many U.K. brokers offer retail forex demo and regular accounts in a spread betting structure. In the United States there are a few options for Forex Trader. 76% of retail accounts lose money when trading CFDs with this provider.

The number of unsuccessful traders slightly outweighs the number of small winners, mainly because of the effect of market https://forex-trend.net/ spread. So the percentage of successful Forex traders is not substantially smaller than the unsuccessful ones.

The safest bet is to consult a professional tax planner right away, as he or she is able to accurately answer all your questions. Furthermore, your accountant can also help you with the preparation of a performance record, which can be more favourable to your bottom line than your broker’s trading statements.

A skilful trader values changes, instead of fearing them. Among other things, a trader needs to familiarise themselves with tracking averagevolatility following financial news releases, and being able to distinguish a trending market from a ranging market. The sooner a trader starts seeingpatience as a strength rather than a weakness, the closer they are to realising a higher percentage of winning trades. As paradoxical as it may seem, refusing to enter the market can sometimes be the best way to be profitable as a Forex trader.

As well as being part of Soros‘ famous Black Wednesday trade, Mr Druckenmiller boasted an incredible record of successive years of double-digit gains with Duquesne, before his eventual retirement. Druckenmiller’s net worth is valued at more than $2 billion. Druckenmiller says that his trading philosophy for building long-term returns revolves around preserving capital, and then aggressively pursuing profits when trades are going well. This approach downplays the importance of being right or wrong. He once told the Wall Street Journal „I’m only rich because I know when I’m wrong“.

Many traders fail for the same reasons that investors fail in other asset classes. Factors specific to trading currencies can cause some traders to expect greater investment returns than the market can consistently offer, or to take more risk than they would when trading in other markets. Improperrisk management is a major reason why Forex traders tend to lose money quickly.

Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don’t need much capital to get started; $500 to $1,000 is usually enough. Note that those numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading by retail investors. On January 15, 2015, the Swiss National Bank abandoned the Swiss franc’s cap of 1.20 against the euro that it had in place for three years. As a result, the Swiss franc soared as much as 41% against the euro and 38% versus the U.S. dollar on that day.