IS FOREX TRADING GAMBLING ? HOW NOT TO TRADE FOREX MARKET

Aspiring traders often ask me whether or not it’s really possible to make a living trading the Forex market. The longer answer is, yes you can make a living trading the Forex market but you have to consistently do a lot of things right. Most traders simply do not yet possess the necessary trading skill, discipline, patience, or realistic attitude to succeed long-term in the markets. Thus, even where a trader’s view of the market is correct, and a currency position may ultimately turn around and become profitable had it been held, traders with insufficient capital may experience losses.

Poor Risk Management

Often perceived as an easy moneymaking career, forex trading is actually quite difficult, though highly engaging. The 2% rule is a money management strategy where an investor risks no more than 2% of available capital on a single trade. I am a new trader, but I doubled my account balance in under an hour, just by using price action analysis of the chart. I have no idea in forex trading yet and have seen your blog.

However, competition among forex is very intense and the majority of firms servicing retail clients find they must attract customers by eliminating as many fees as possible. This has led many to offer free or very small transaction costs beyond the spread. Forex brokers are firms that provide traders with access to a platform that allows them to buy and sell foreign currencies.

The longer track record a broker has, the more proof we have that it has successfully survived previous forex brokers rating financial crises. This means that it hasalready survived one crisis, which is a good sign.

Trading with a true STP broker is usually a good idea for novice and intermediate traders. And it is in an STP broker’s interests that their clients succeed and make money so that they keep on trading, for novices traders, having a broker that they can be sure is 100% ‘on their side’ is a huge plus. If you have already read the first article in the series, Structure of the Forex Market, you will recall that market mechanics are responsible for the variation in bid/ask spreads, and also for slippage. So it seems the two biggest novice traders’ pet peeves are not so much a function of who their broker is, but rather their lack of understanding of the way the forex market operates. Some brokers also offer guaranteed order fills, such as “guaranteed stop losses”.

Compared with any other financial markets, the forex market has the largest number of market participants. This provides highest level of liquidity, which means even large orders of currency trades are easily filled efficiently without any large price deviations. This eliminates the possibility of price manipulation and price anomalies, thereby enabling tighter spreads that lead to more efficient pricing. One need not worry about the high volatility during opening and closing hours, or stagnant price ranges during the afternoons, which are trademarks of equity markets.

Most traders know that it takes money to make a return on their investment. One of Forex’s biggest advantages is the availability of highlyleveraged accounts. This means that traders with limited starting capital can still achieve substantial profits (or indeed losses) by speculating on the price of financial assets.

While many of these indicators are well-suited to the forex markets, it is important to remember to keep analysis techniques to a minimum in order for them to be effective. Using multiples of the same types of indicators, broker umarkets such as two volatility indicators or two oscillators, for example, can become redundant and can even give opposing signals. Just because forex is easy to get into doesn’t mean due diligence should be avoided.

Are you looking to speculate that the Euro (EUR) currency will go up in value against the US Dollar (USD)? If so, you will want to trade (or spread bet) the EUR/USD currency pair. The forex market is the largest and most liquid market in the world, representing every global currency with trading conducted 24 hours a day, five days a week. Forex options trading allows currency traders to realize gains or hedge positions of trading without having to purchase the underlying currency pair. Perseverance, continuous learning, efficient capital management techniques, the ability to take risks, and a robust trading plan are needed to be a successful forex trader.

Any investment that offers potential profit also has downside risk, up to the point of losing much more than the value of your transaction when trading on margin. This article can help understand the risks so you trade successfully. If you’re day trading a currency pair like the GBP/USD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). Therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade. That also means a winning trade is worth $80 (8 pips x $10).

Because there is no central marketplace disseminating minute-by-minute time and sales reports, banks and FCMs must rely on their own knowledge of prevailing market prices in agreeing to an execution price. The execution price obtained for a trader/customer to a large extent will reflect the expertise of the bank or FCM in trading the particular currency. While https://forexarticles.net/ the OTC interbank market as a whole is highly liquid, certain currencies, known as exotics, are less frequently traded by any but the largest dealers. For this reason, a less experienced counter-party may take longer to fill an order or may obtain an execution price that differs widely from what a more experienced or larger counter-party will obtain.

- It is based on the effect of continuous and usually volatile shifts in the worldwide supply and demand balance.

- This is the time to exit trading for the day and keep the account balance intact.

- Chasing the price – which is effectively opening and closing trades with no plan – is the opposite of this approach, and can be more accurately described as gambling, rather than trading.

- A foreign exchange account, or Forex account, is used to hold and trade foreign currencies.

- Historically speaking, several hedge fund managers have been able to get rich trading forex.

- When it comes to trading foreign currency, you use a forex broker, also known as a currency trading broker, to place your trades.

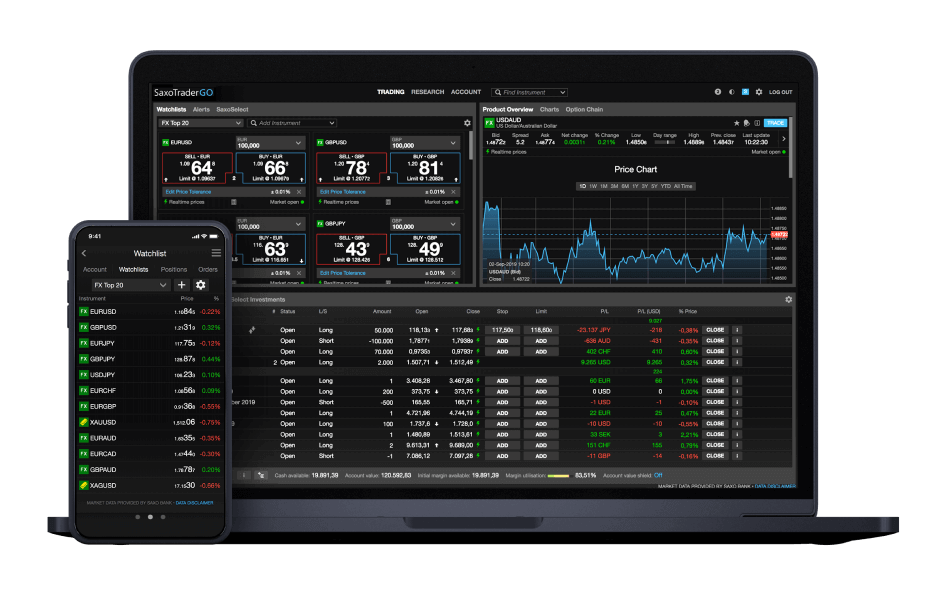

IG is our number one recommendation for traders that desire an excellent platform experience. From technical analysis on charts to integrated trading signals, streaming news, and premium research, IG has done an excellent job making everything on its platform compact and easily customizable for traders.

Brokers may be acting as market makers (dealers) to execute your trades or acting as agents for execution (relying on other dealers to do so for them). Also, not all brokers publish their average spread data, and for those who do – not all brokers record their average spread over the same time-frames, making it difficult to make an accurate comparison.

Fitting Forex trading around a busy schedule isn’t always easy. Between work, family, and your social life, finding time to trade can be a challenge. By trading with securities you are taking a high degree of risk. You should start trading only if you are aware of this risk.

For some cheating brokers, “regulation” is just a tool to attract more traders to open accounts. They get regulated and registered because they have to, not because they are honest.

He has a monthly readership of 250,000+ traders and has taught 20,000+ students since 2008. In 2016, Nial won the Million DollarTrader Competition.Checkout Nial’s Professional forex brokers rating Trading Course here. Get 50% Off Nial Fuller’s Price Action Forex Trading Course, Daily Trade Ideas Newsletter & Live Trade Setups Forum – Click Here For More Info.

Most beginners quit during the initial phase, primarily because of losses suffered due to limited forex trading knowledge and improper trading. Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets. Forex trading is unique in the amount of leverage that is afforded to its participants. One of the reasons forex is so attractive is that traders have the opportunity to make potentially large profits with a very small investment—sometimes as little as $50. Properly used, leverage does provide the potential for growth.

quiz: Understaning of Money management – protecting your capital

If necessary, print the form if it is to be completed by hand. Note on the form how the cash withdrawal should be handled. Most Forex brokers provide an option to wire the funds to your bank account. This almost always incurs a wire transfer fee on both ends, charged by your broker and also your bank. Otherwise, you may optionally choose to receive a mailed check if your broker offers this service.