Is trading in Forex a Ponzi scheme?

Closing your trade

Otherwise, you may optionally choose to receive a mailed check if your broker offers this service. However some brokers also charge a separate fee to print and mail a check. This option would not incur a fee on your bank’s end. If I’m comfortable losing $100 and not $1000 in a new venture, then what’s the big deal? To me, trading shouldn’t be about impressing some person and opening an account with $1000 just to show that you’re ”serious”.

More specifically, the spot market is where currencies are bought and sold according to the current price. After a position is closed, the settlement is in cash. Although the spot market is commonly known as one https://dowmarkets.com that deals with transactions in the present (rather than the future), these trades actually take two days for settlement. Risk/reward signifies how much capital is being risked to attain a certain profit.

I can keep occupied and stop losses seem stupid just wait til goes back up. I never use Stop Loss and when capital is locked up in Drawdown I wait for the reversal to happen or liquidate trades when initial account equity crashes to 50%. Totally agreed with the number of trades will increase the probability of profit if your winning rate is greater than losing. Eventually the losing trades will be covered by winning trades.

Into my second week now I am making $1000 day on a $50,000 account. That’s why most full-time traders don’t trade off the daily timeframe because it takes too long for https://dowmarkets.com/online-platform/ the law of large number to work in your favor. Hi man, I’ve been your following your posts lately. I am just curious, how many traders do you do per day on average?

Foreign exchange marketsprovide a way tohedge currency risk by fixing a rate at which the transaction will be completed. In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange. Futures contracts https://dowmarkets.com/online-platform/ have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterpart to the trader, providing clearance and settlement. The foreign exchange market is where currencies are traded.

For example, imagine a company which will need $100,000 in 30 days for paying its employees, but it will receive its revenue in euro. Since it wants to specify the exact exchange rate it can get in 30 days, it will seal a forward contract with a big bank at a fixed price, let’s say 1.1710. After 30 days, they will exchange the currencies and the company will receive €85,397 ($100,000/1.1710). Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets.

This means the excitement from your first real profit will fade when you realize it’s only $4. Not only that, but it took four trading days or Forex almost 100 hours to do it. Now, in a perfect world you would relish the idea that you just pulled out a 4% profit in just four trading days.

While trading a forex pair for two hours during an active time of day it’s usually possible to make about five round turn trades (round turn includes mt4 web entry and exit) using the above parameters. If there are 20 trading days in a month, the trader is making 100 trades, on average, in a month.

#5 Fusion Markets Verdict

- That’s not to say you can only make 20% a year because, for a day or swing traders, the percentage could be higher (as you have more trading opportunities).

- Oliver Dudok van Heel of the Lewes Pound team recommends a mixed team of traders and residents.

- After that first profitable month, I was profitable every single month after for the next 4.5 years.

- If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she’s losing on losers.

Standard stop losses and limit orders are free to place and can be implemented in the dealing ticket when you first place your trade, and you can also attach orders to existing open positions. A guaranteed stop loss however, for which a small premium is charged upon trigger, guarantees to close your trade at the stop loss level you have determined, regardless of any market gapping. For every point the exchange price rises above your open level, you will incur a net loss. Your profits will rise in line with each point the exchange price falls. For every point the exchange price falls below your open level, you will incur a net loss.

On the contrary, now I only day trade for two hours (or less), and swing trading only takes about 20 minutes a day. But at the beginning, you need to practice trading. And when you aren’t practicing actually placing trades, you are looking at charts, studying tendencies, testing strategies, and working on your mental game. Working two hours a day is the end result; at the beginning, you need to put in more time than that if you want to be consistently profitable within several months. A trading journal is an effective way to learn from both losses and successes in forex trading.

In this case, you effectively never convert your dollars to euro. If your bet was correct, the profit from your trade will be booked to your account in US dollars. If you were wrong, the loss will be deducted from your account in dollars as well. Although it looks easy, trading with forex can be risky if you don’t know what you’re doing. By using high leverage irresponsibly, you can easily lose all of your money within a couple of seconds.

While learning to trade is time-consuming for the first year, once you are consistent you’ll likely only trade a couple hours, or less, a day. With that much free time, have another income stream. This will also take some pressure off your trading. If you take a couple weeks off from trading, it could take a couple days to get your feel for the market again. If you take a few months off, it could take a few days or weeks to regain your edge.

If a strategy worked, but no longer is, ask yourself why. Are you just barely getting stopped out or are you completely wrong? Assuming you’ll be one of the profitable ones, it’ll likely take six months to a year–trading/practicing every day–until you are consistent enough to pull a regular income from the market.

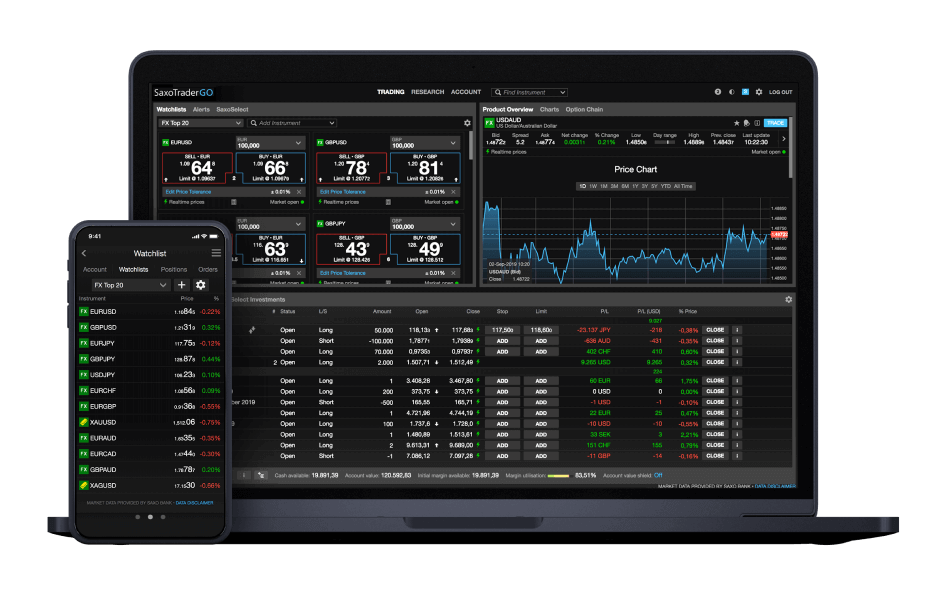

Saxo offers a user-friendly and well-designed trading platform,backed by great research. The product portfolio covers all asset types and many international markets. Because if you fund your account in the same currency as your bank account, currency conversion fees won’t be charged.

300+ pages and more than 20 strategies combined with trading psychology and a proven 5 step method for becoming a winning trader. Whether you come up with your own methods, or use someone else’s, it is likely going to take you 6 months to a year until you develop enough consistency to start seeing recurring monthly profits.

You can still pay all your bills, provide for your family, etc. Lose too much of it while trading and you may be put off by the notion of risking money in financial markets altogether.

Depending on where the dealer exists, there may be some government and industry regulation, but those safeguards are inconsistent around the globe. Since the market is made by each of the participating banks providing offers andbidsfor a particular currency, the market pricing mechanism is based on supply and demand.