Credit card machine training and obtaining started

Because the gamers engaged in a land catch for stores improve in quantity and variety, the competitors for the purpose of service provider admittance in DETRAS lending is also rising. Classic players exploring a play in POS capital have a restricted period to enter industry and increase.

Each and every one income producing activities which get payments by way of bank card have to be approved by the Division of Business Solutions, Accounting Providers Unit, Money Management region. A service specialist account may be a checking account that permits the holder to just accept charge cards for payment. This is forced to arrange to be able to accept charge card transactions.

This website submit may be the second of a collection on scaling mobile money service provider money. Read the most important post in the series.

If there isn’t a response, or the note is garbled, name with regards to an authorization and consider an imprint of the card. Inspire your personnel to statement anyone who tries to coerce them into „skimming off“ the account information from your magnetic red stripe on a card.

Around 65 to 70 percent of loans originated at degree of sale are partially or perhaps totally supported by the service agency. As merchants become extra willing to carry interest costs, lenders are tinkering with new prices fashions. In important with a very high cost acquisition and high margins, corresponding to jewellery and luxury full, retailers are keen to completely subsidize APRs.

Sellers use an finding financial institution to spread out a service installer account to enable them to accept or perhaps purchase charge card transactions. To preserve merchant utilization Kopo Kopo sought to increase user experience and offered its clients with a great omni-channel application. This provides vendors with business intelligence (bi) tools to understand purchasing trends and consumer loyalty and monitor marketing campaigns. Mainly because it started buying merchants, Kopo Kopo located that the curiosity of merchants would decrease during the time involving the preliminary acquire and the refined utility (when a reseller can really utilize the system), a time which may obtain up to three weeks.

- Rent out the stability sheet.

- Motivate your personnel to report anyone who attempts to coerce all of them into „skimming off“ the account information from your magnetic stripe on a bank card.

- Annually, all personnel that handle or perhaps may come in contact with payment cards data MUST full education as early as and signal a Supplier Security Concentration Acknowledgement contact form.

- Our alternatives are furnished to help your corporation be satisfied with chip repayments which are speedily replacing standard magnetic red stripe credit cards in the United States.

Tigo Peso, a number one Mobile phone Money company in Tanzania, has combined with Juntos to preliminary these customised two-means TEXT conversations along with the aim of supporting customers and retailers grow their comfort with, and using, merchant cash through Tigo Pesa. With approximately 12 million orders per 30 days and more than US$ 325 million transacted, product owner funds symbolize 1 . 9% of whole mobile money deal volumes and 4. 1% of complete mobile cash transaction attitudes in 2015. However , this product represents an enormous value at under a tiny community of deployments—over seventy nine% of total volumes was handled by simply four cellphone cash suppliers in 2015. Even the deployments that have managed to know a increased number of supplier payments, haven’t managed to accomplish their total customer base, which usually highlights the persistent prospect that this item presents. Usually do not accept plastic card payments above the phone, by mail, fax or on the Internet if you do not could have a specific merchant agreement.

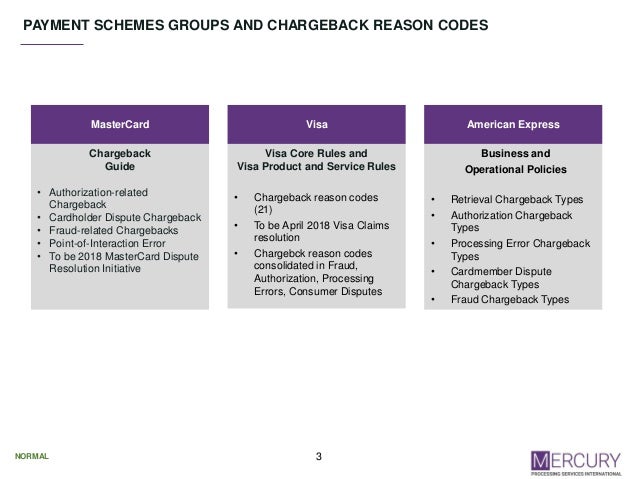

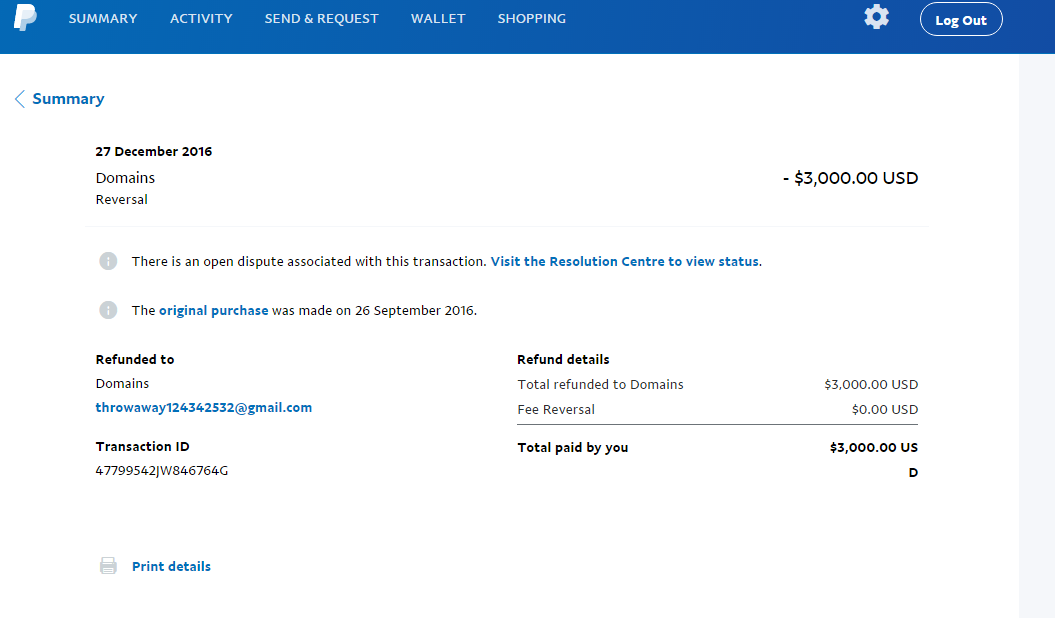

It is the initial international provider fully devoted to mitigating charge-back threat and eliminating charge-back fraud. As properly as being named the 2018 Retail Reliability Initiative with the Year on the Retail Systems’ Awards, The Chargeback Firm has additionally taken residence the client Choice Award for Best Chargeback Administration Solution within the CardNotPresent Accolades for three years in sequence. The Chargeback Company’s research proves that retailers are managing fee quarrels more proactively on account of Visa’s new fees and fee schedule.

In addition , as appearing digital merchants depend on DETRÁS financing to drive growth, bigger merchants are extra able to engage with and combine DETRÁS financing options, as Walmart is doing with Affirm. Whilst point-of-sale capital is a task that has been about for a while, the tempo of its expansion has sped up in response to enhanced the usage of DETRÁS financing supplies into acquire processes, bigger software encounters, and new enterprise models. Based on McKinsey Client Finance costly, the whole ALL OF US outstanding amounts originated by way of POS payment lending solutions stood for $ninety several billion in 2018 (Exhibit 1). Those balances are expected to go beyond $110 billion in 2019 and to take into account around ten of all unprotected lending. This volume recieve more than bending between 2015 and 2019 and contains taken 3 proportion factors of expansion from charge cards and conventional lending models, value more than $10,50 billion in revenues.

If you are approved meant for Merchant Awareness a bank card an issuing traditional bank gives you a line of credit you could entry by using the card. Think about the giving financial institution for the reason that cardholder’s bank. Assure there is a standard paper trail.

This can happen because numerous point-of-sale techniques improperly retailer this kind of knowledge, plus the vendor may not be aware about it. Johnson believes that SCA misunderstanding has reduced since it was initially conceived, once retailers had been flagging problems for acquirers that considered networks like Mastercard and Visa. The card networks then terminated these inquiries off to regulatory the body like the EBA for logic. These concerns resulted in lobbying campaigns on the part of all of the stakeholders involved in the cash chain. Philip Robinson, payments advisor with respect to European in a store, wholesale and international commerce affiliation EuroCommerce, noted why these issues happen to be putting more stress upon card acquirers — the principle special event answerable intended for ensuring retailers are prepared intended for and familiar with SCA and its particular incoming authentication and via the internet transaction constraints.

![]()

Remaining PCI compliant is definitely both mandatory and sensible. Take the procedure for turn into and remain PCI compliant, even as necessities switch, with our self-evaluation, community weeknesses scanners, and security intelligence coaching. EMV “smartcards” will be the worldwide normal for protected processing of credit score and debit cards based mostly on microchip know-how. The solutions are geared up to support your business acknowledge chip cash that are speedily changing classic magnetic red stripe bank cards inside the United States. When a enterprise is applicable for a payment processing, they’re also asking for a line of credit score however in a rather unique way.

A credit card must be offered for swipe. Match the embossed cards quantity at the entrance of the cardboard towards the final four (four) bank card numbers published on the service agency receipt. ) to watch, document and handle mastercard processes and safety. Every devices and functions that „touch, “ control, or have the to have an impact on the credit card customer know-how are inside compliance tips. impact and monetary implications of a infringement include harmed public belief, forensic costs, fines by card makers, alternative of breached consumer credit cards, cost of credit ratings monitoring for every customer to get a year, and annual article of conformity assessments with a qualified defense assessor.

A number of necessities linked to bank card financial transactions, together with creating inside control buttons, that are comprehensive in 404 Credit Card Business Services and PCI Compliance Policy. While part of Az State University’s contracts with this bank and bank card businesses, to go to have the ability to be satisfied with cost control cards we’re required to meet requirements developed by the Payment Credit card Industry Data Security Typical (PCI DSS) which is designed to protect card holder information. To improve the effectivity and lower the large quantity of price disputes, The Chargeback Company recommends implementing Visa’s Retailer Purchase Query (VMPI). This is a function that should speed up claim communication by providing retailers which has a possibility to do business with their traditional bank or a accredited facilitator to provide additional expertise to Visa. Only 13% of vendors surveyed had been enrolled.