You can easily achieve the trading targets by properly seizing each and every opportunity you received. The first is simply to avoid specialized Forex traders entirely and to trade with a general stock brokerage active in the U.S. and therefore regulated by the U.S.

High degrees of leverage means that trading capital can be depleted very quickly during periods of unusual currency volatility. These events can come suddenly and move the markets before most individual traders have an opportunity to react. Before you begin forex trading, you’ll need to choose a brokerage firm.

On Jan. 15, 2015, the Swiss National Bank abandoned the Swiss franc’s cap of 1.20 against the euro that it had in place for three years. As a result, the Swiss franc soared as much as 41% against the euro and 38% versus the U.S. dollar on that day. While this could be interpreted to mean that about one in three traders does not lose money trading currencies, that’s not the same as getting rich trading forex.

Here’s how to become a forex trader in 7 simple steps

Your brokerage firm will help you make trades, and many brokers also offer additional financial services. Professional traders need to leave emotion out of their avatrade trading. Psychologically, you will need to steel yourself for the severe financial losses that typically accompany the first few months of day trading.

If you gain enough experience, you can trade with larger amounts. The benefit of trading with low deposit forex broker for beginners is that risk is minimal as you would be protected from significant financial losses. You can learn the basics of the commodities markets by reading and studying.

Even great traders have strings of losses; if you keep the risk on each trade small, a losing streak can’t significantly deplete your capital. Risk is determined trade99 by the difference between your entry price and the price at which your stop-loss order goes into effect, multiplied by the position size and the pip value.

Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. n contrast, a larger account is not as significantly affected and has the advantage of taking larger positions to magnify the benefits of day trading. A small account by definition cannot make such big trades, and even taking on a larger position than the account can withstand is a risky proposition due to margin calls. Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital.

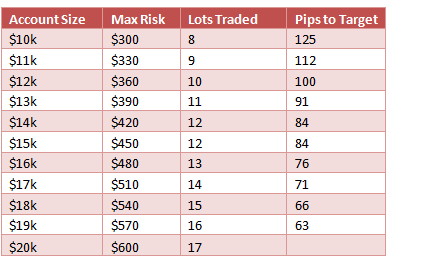

Recommended Capital

The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account. Traders often enter the market undercapitalized, which means they take on excessive risk to capitalize on returns or salvage losses. The most important step within the Forex trading and we all know that the successful traders within the market will never procrastinate.

- For this post’s purposes, there are four common types of Forex accounts.

- Not all brokerage firms offer forex trading, so make sure it’s available before you open an account.

- The confusing pricing and margin structures may also be overwhelming for new forex traders.

- Once you understand the theories, products, and institutional players in the markets, spend some time testing your knowledge with a paper trading simulator.

- He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices.

- The same account is offered by FXTM as the name of Cent Account.

Unexpected one time events are not the only risk facing forex traders. Here are seven other reasons why the odds are stacked against the retail trader who wants to get rich trading forex brokers the forex market. Note that the Bloomberg numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading.

A trading journal is an excellent reference as it shows you how well your trading strategy performs in different market conditions. By following a trading journal, you will develop a greater avatrade level of confidence and will learn to trade with discipline. Remember, it is very difficult to make profits from every single trade that you execute, so don’t be afraid when losses do occur.

It’s also important that your selected broker offers reliable account features including low spreads, fast execution and negative balance protection. Forex (FX) is the market where currencies are traded and the term is the shortened form of foreign exchange.

However, as any successful trader will tell you, you learn something new and face new challenges every day. The most successful commodity futures trader is flexible and thrives under pressure. The first year of trading commodities should be all about learning how to trade. There are important lessons to absorb when it comes to approaching markets, executing trades, and controlling risk. If you don’t plan on day trading, but you still want to make a living trading, you’ll need to make every trade worth more.

Since you won’t be able to execute as many trades, each trade needs to be for a significant sum—and the more money you put into a trade the more you expose your portfolio to risk. Forex brokers have offered something called a micro account for years. The advantage for the beginning trader is that you can open an account and begin trading with $100 or less.

Forex is the largest financial marketplace in the world. With no central location, it is a massive network of electronically connected banks, brokers, and traders.

A trader who deposits $1,000 can use $100,000 (with 100 to 1 leverage) in the market, which can greatly magnify returns and losses. This is considered acceptable as long as only 1% (or less) of the trader’s capital is risked on each trade. This means that with an account size of forex brokers $1,000, only $10 (1% of $1,000) should be risked on each trade. Best practices would indicate that traders should not risk more than 1% of their own money on a given trade. While leverage can magnify returns, it’s prudent for less-experienced traders to adhere to the 1% rule.

Unfortunately, the benefits of leverage are rarely seen. A consequence of that is that unless you look carefully into the reputation of the Forex broker you select, you may be defrauded. To become a day trader who makes consistent profits, you need to implement stop loss and take profit orders to protect against unanticipated market reversals avatrade and minimise risk. These should be predefined before any trade is placed and should only be placed once you have carried out in-depth market analysis. The first step in becoming a day trader is to find a reputable forex broker who offers competitive trading conditions, powerful trading platform technology and excellent client support.

Even when it comes to capital for your brokerage account, day traders need significant capital to trade in earnest. FINRA has special requirements for „pattern day traders,“ who are defined as those who open and close a position on the same day at least four times per week. Novice investors, buoyed by their success with paper trading simulations, may take the leap of faith and decide that they’re going to earn their living from the stock market. Some find success, feeding fantasies of sitting on a tropical beach, making a killing with nothing more than a laptop and an internet connection. However, many people who independently trade for a living use day trading strategies, and studies have shown that the majority of day traders lose money over the long-term.